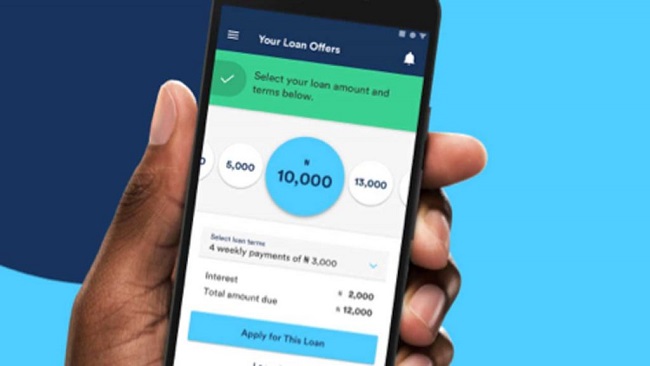

Their approach at the beginning is often innocuous but in most cases, it ended up a trap. For the ubiquitous Fintech companies – organisations that adopt technology to carry out various financial services to its customers with an accompanying service charge on their products – accessing soft loans is as easy as punching a computer keyboard. A number of these loan sharks set their customers up to be able to earn abnormal interest from unsuspecting borrowers. They cyberbully their borrowers to the extent that they suffer integrity and character damage. TUNDE OLASUPO takes a look at some of the licensed and top digital lenders in the industry that have demonstrated a high professional etiquette in the discharge of their businesses.

BRANCH

Branch App is owned by Branch International. The company was co-founded by Matt Flannery and Daniel Jung. Matt Flannery serves as the Chief Executive Officer (CEO) for the Branch while Daniel acts as Chief Operating Officer (COO). Ms Dayo Ademola oversees the Nigerian business hub as the Managing Director. With over 20 million active users and offices across Nigeria, Kenya, Tanzania and India, Branch International has continued to redefine digital finance. Branch International began its foray in Africa in Kenya in 2015 and entered Nigeria as a lending app in 2017. Fully licensed by the Central Bank of Nigeria as a Fintech and has a record of processing over 40 billion Naira in over 3 million transactions in the past three years of operation. It has been rated as one of the best in terms of customer service.

CARBON

Carbon was founded by two brothers from Nigeria, Chijioke Dozie and Ngozi Dozie in 2012. It is a fully digital lending platform that has provided credit advances to Nigerians in the last eight years. Carbon has a customer base of almost 700,000 and has processed more than 25 billion credits. Carbon presence in Africa also extends to Kenya. In its quest to become a digital bank, Carbon had acquired a microfinance bank licence which it said would create additional protection through depositor’s insurance via the NDIC.

IN CASE YOU MISSED THESE FROM RULERS WORLD

- Traditional rulers, Obasanjo, senators, others grace 8th-day prayer for late Olubadan

- (JUST IN) JAMB to hold UTME from May 6, registration begins on February 12

- No ruling house has endorsed MC Oluomo, says Regent of Oshodi land, Akinola

FAIR MONEY

Fair money was co-founded by three partners, Laurin Nabuko Haney, Matthieu Gendreau and Nicolas Berthozat. Laurin also doubled as CEO of the company. It has provided credit through a loan app in the last four years and has also evolved to a digital bank with its microfinance bank licence from the Central Bank of Nigeria. It started its operations in Nigeria in 2017 providing instant loans and bill payments to customers in Nigeria. Fair money is present in Nigeria, France and India. Its registered user is around 5 million.

PALMCREDIT

The Palm Credit Loan is a subsidiary of Transnet Group. Transnet Group is also a subsidiary of Transsion Holdings according to the information on their website. Transsion is the parent company of Africa’s most popular smartphone brands: Tecno, Infinix and Itel. Other loan apps under the group include Palmpay and Palmsave. The Palmcredit Loan operates under CBN licensed New Edge Finance Limited based in Nigeria.

MIGO

The known brain behind Migo is Dr Ekechi Nwokah. Migo was formerly known as Kwikmoney and Kwikcash. It is a platform designed to lend long and short term loans to individuals and corporate bodies. Migo is not just a money lending platform but also an online payment processor that will be used to receive and make payments. It is Nigeria’s first instant loan service. Migo operates under a licensed microfinance bank, Support Microfinance Bank. It started with a partnership with Etisalat Nigeria in which case only Etisalat users were able to benefit from its services initially. However, It has extended its services to other networks. Migo uses USSD as a lending platform to reach its numerous customers.

YOU SHOULD NOT MISS THESE HEADLINES FROM RULERS’ WORLD

“We had some really good, quality time there,” Jeff Bezos said of travelling outside of Earth with his brother Mark. Loan Sharks: Lifting The Veil Loan Sharks: Lifting The Veil Loan Sharks: Lifting The Veil Loan Sharks: Lifting The Veil